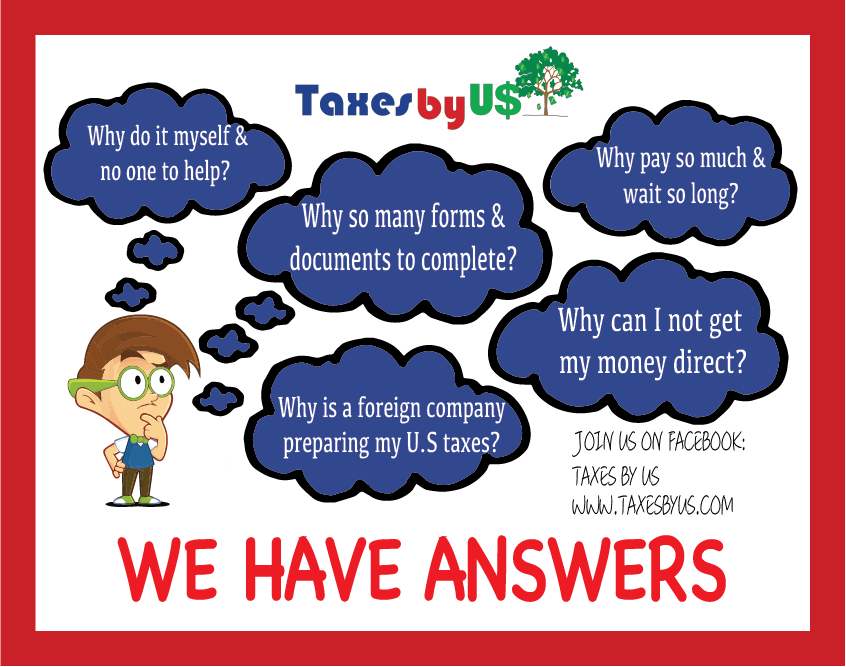

TAXES BY US full-service at DIY prices only $109, 5 minute questionnaire & attach documents, direct contact modes, nothing remote & after complete Sprintax is DIY, online only, no direct contact or assistance & starts at $97

Glacier is DIY, online only and no direct contact or assistance

To Keep our Country & States Running by Funding Them

To Provide Revenues for the U.S. Federal, State & Local Governments

To Fund Social Programs & Projects, Services, Goods & Activities of All Kinds

Every individual & business with any income generated in the U.S.

Pay yearly mandatory taxes

Per the IRS Website:

IRS receives data directly from 3rd parties – employers & fin’l institutions

Automated system compares information reported to your tax return

Income Tax: Amount you pay & withheld from paycheck each pay period I

Three types:

1. Federal (everyone pays Federal)

2. State (all income states & you on CPT or OPT except 9 States)

3. Local (all local tax municipalities like NYC, Chicago, LA, St Louis, et al)

Deducted from Your Employee Paycheck Each Pay Period

– Federal Income Tax Withdrawal

– State Income Tax Withdrawal

Adjusted by Filing 1040 NR Tax Returns

Not an Income Tax return

An informational Statement for U.S. Non-Residents

To Claim Exempt Individual on Substantial Presence Test

All F-1, J-1, M-1 Student Visa (including your spouse and/or dependent Students Studying &/or on Working CPT or OPT in U.S. 5 Years or less

Prove exempt individual did not meet substantial presence test

Mandatory legal obligation, stay compliant & requirement of the U.S.

Did not file prior years, IRS says better late than never filing

Send each Form 8843 separately with a letter of explanation

Or ask Taxes by US to do it just for $15 per form + postage

Visit website on IRS website and Do-It-Yourself

Simply let Taxes by US send you a 5-minute questionnaire, attach few documents & prepare and send for you for only $15 + postage

Per the IRS

Unlike not filing tax returns – no monetary penalty but other consequences

Not file Form 8843, you may not exclude day present in the U.S.

Being considered a U.S. resident under SPT

Can affect future visa applications

NEVER…NEVER…NEVER….NEVER…only if you are a U.S. resident meaning

F, J, M student & exchange: 5 or 5+ years in U.S., passed SPT & filed F 8843 TurboTax only file Form 1040 for U.S. individuals (Google Form) and

U.S. Nonresidents file Form 1040NR for Nonresidents

If you filed incorrectly with TurboTax when IRS reviews or audits lead to huge penalties, accumulating interest and fees (Google)